Visa Chargeback Reason Codes: What They Mean

In our previous blog posts, we have discussed chargebacks, how they happen, and how to prevent them. This time we want to introduce you to chargeback reasons provided by Visa.

To make it easier for you to recall what chargebacks are, here is a short description of the process. When a cardholder is not happy with their purchase, they can contact their bank and file a chargeback. The bank sends the dispute information to the merchant’s card processor. If you are using Cardinity, then we will receive the chargeback information on your behalf and forward it to you. The merchant can either accept the chargeback and lose the funds or reject it and provide compelling evidence. What is meant by compelling evidence? It is the documents which can prove that a customer participated in a transaction in question and received their order.

In this post, you will find the most common chargeback reason codes for card-absent (card-not-present) Visa transactions.

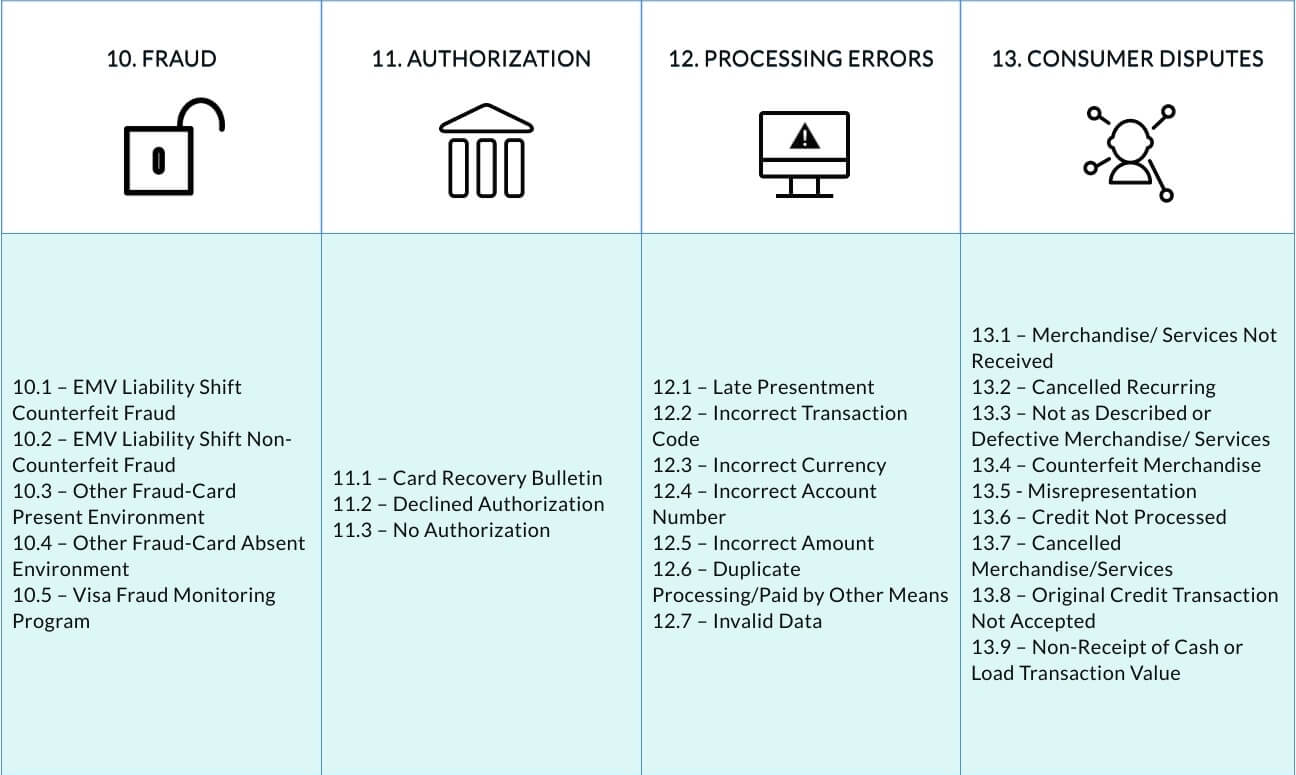

Visa classifies disputes into four categories: Fraud, Authorization, Processing Errors, and Consumer Disputes. Dispute conditions which we recommend you to remember are the following ones:

- Fraud category: Condition 10.4 Other Fraud – Card-Absent Environment.

- Authorization category: Condition 11.3 No Authorization.

- Processing errors category:

- 12.5 Incorrect Amount;

- 12.6.1 Duplicate Processing;

- 12.6.2. Paid by Other Means

- Consumer disputes category:

- 13.1 Merchandise/Services Not Received;

- 13.2 Cancelled Recurring Transaction;

- 13.3 Not as Described or Defective Merchandise/Services;

- 13.5 Misrepresentation;

- 13.6 Credit Not Processed;

- 13.7 Cancelled Merchandise/Services.

Condition 10.4 Other Fraud – Card-Absent Environment

You can get this reason code if a cardholder did not authorize the transaction or did not participate in it at all. This means that somebody used an account number in a fraudulent way without the cardholder’s permission. It can also indicate that the cardholder was not able to recognize the charge on their bank statement and believes that the transaction was fraudulent.

What to do: In general, a transaction cannot be fraudulent if the cardholder was authenticated (Verified by Visa). Hence, you have the right to dispute such a chargeback and provide evidence that the transaction was legitimate. In order to prevent this Visa chargeback condition, always use 3D Secure and verify your customers.

Condition 11.3 No Authorization

Authorization is the process of communication with the cardholder’s issuing bank when it sends a response whether the transaction should be approved or declined. The issuing bank checks whether the card has sufficient funds and whether it is not lost or stolen. You can receive the No Authorization chargeback when a transaction was processed but was not authorized. This chargeback reason is actually very rare, but it is useful to know it.

What to do: If the transaction was not authorized, you should simply accept the chargeback. If the transaction was authorized, inform your payment processor about it and provide evidence. In the future, make sure every transaction is properly authorized before capturing the funds.

Condition 12.5 Incorrect Amount

A simple explanation of this condition is that you have entered a wrong transaction amount, or the amount was incorrectly calculated. It can also happen in case of some system errors. If you change the amount without the cardholder’s consent, it might cause this chargeback as well.

What to do: If the transaction amount is correct, provide evidence. If the cardholder is right, and the amount is incorrect, accept the chargeback. When you notice errors in the amount, make sure to act quickly and contact your customer before they reach their bank.

Condition 12.6.1 Duplicate Processing

Duplicate processing indicates that a transaction was processed more than once.

What to do: If this is the case, provide evidence that the cardholder was charged only once. If the transaction was really duplicated, you should accept the chargeback. Always be careful not to enter the same transaction into the terminal more than once. Track your transactions, and if you see duplicate payments, immediately refund the duplicate and inform your customer.

Condition 12.6.2. Paid by Other Means

You can receive this chargeback from Visa if your customer has initially submitted a card to pay and then decided to use another payment method, but you have already completed the transaction.

What to do: Accept the dispute if the customer has really used another payment method. Otherwise, provide evidence that no other payment method was applied. If it happens that your customer uses two different payment methods for the same purchase, and you do not void the card transaction, you should refund it as soon as you notice it.

Condition 13.1 Merchandise/Services Not Received

This Visa chargeback condition is very common. A cardholder claims that they did not receive the service or merchandise they ordered. Some of the reasons why the order did not reach the cardholder can be as follows:

- The merchant did not provide the services;

- The merchandise was not delivered by the agreed-upon date;

- The merchandise was not delivered to the correct address;

- The merchant did not make the order available for pick-up;

- The cardholder did not receive the merchandise by the agreed-upon date and cancelled the order, but the refund was not made.

What to do: If you delivered the order or made the order available for pickup before the expected delivery date, you have the right to dispute the chargeback and provide compelling evidence. You should provide pictures of your shipped product, the tracking number and receipt with the customer’s signature. If the expected delivery date has not yet passed and the cardholder cancelled the order, provide supporting documents as well. In case you did not provide services or merchandise as agreed, and the dispute is legitimate, accept it. Please note that in order to avoid such chargebacks, make sure to stay in touch with your customer, always inform them about any delays and expected delivery dates, and allow them to cancel the order. It is recommended that you choose registered delivery methods and provide tracking numbers to your customers in order to reduce Visa chargeback rates.

Condition 13.2 Cancelled Recurring Transaction

If you process recurring payments, there is always a chance that you might get a chargeback. A cardholder should be able to cancel a subscription at any time. However, sometimes customers cancel recurring billing after a transaction has already been processed without their knowledge.

What to do: If the cardholder cancelled the services, but you still processed the payment and did not refund it, you should accept the chargeback. If the cardholder cancelled subscription payments but was still using the services afterwards, then you should provide evidence that the payment in question covered the services used by the customer. Make sure that the service cancellation policy is easily accessible on your website, and your customers are able to cancel subscriptions in their accounts. Keep in touch with the customer and notify them when their recurring payment account is closed.

Condition 13.3 Not as Described or Defective Merchandise/Services

To file this chargeback, a cardholder contacts their bank for one of the following reasons:

- Services or merchandise were not as described on the receipt or the website at the time of purchase. You might have sent the wrong merchandise, or the services/merchandise were described inaccurately.

- The customer received damaged or defective merchandise. It might have been damaged during shipment.

- The received merchandise or services were of very low quality.

What to do: It is very difficult to prove that a certain item matches its description; however, you have the right to refute the cardholder’s claims and provide evidence that the merchandise is as described. Additionally, provide evidence if the cardholder has already agreed that you will replace or repair the item. In order to avoid such chargebacks, ensure that descriptions of your services and products are accurate and not misleading.

Condition 13.5 Misrepresentation

Merchants can receive a chargeback with this condition if the cardholder claims that products or services were misrepresented. It can happen when the service descriptions are vague and inaccurate. This applies for the following business activities: timeshare reseller; debt consolidation; credit repair/counselling; mortgage repair/modification/counselling; foreclosure relief services; technical services/support; business opportunities with income possibility; investment products; trial periods. Cardinity does not support the aforementioned businesses.

Condition 13.6 Credit Not Processed

If you did not issue a refund to your customer that you agreed on, your customer might file a chargeback. They may also file a chargeback if the refund is not yet visible on their account statement. Moreover, when a cardholder cancels a transaction and you do not void it, they may dispute this payment as well.

What to do: If you don’t have to make a refund to the customer, or you have already issued it, provide evidence to dispute the chargeback. Always issue refunds promptly and keep in touch with your customers.

Condition 13.7 Cancelled Merchandise/Services

You can receive a chargeback with the code 13.7 if your customer has returned the merchandise to you or cancelled services, but the refund did not appear on their statement. There are several different scenarios of how this could happen. For example, you simply forgot to issue a refund for the returned order, or you did not return the money for a cancelled reservation. It might also be the case that you do not issue refunds and do not accept returns at all; however, you did not disclose it clearly in your return policy.

What to do: If your policies were properly disclosed, but the customer did not act according to them, you should provide documentation to support your claims. If you have never received the returned merchandise, or the customer was still using your services, you can provide evidence to prove it as well. Check whether your policies are easily available and clear to customers. Make sure your website requires your customers to accept your refund policy. If you never issue refunds, you must distinctly indicate it in your refund policy. The cardholder must have access to all the terms and conditions of purchase on the checkout screen.

Summing up

If you receive a chargeback from your customer, Cardinity will inform you immediately about all the details. You have the right to dispute chargebacks, so don’t hesitate to contact us and collect compelling evidence. If a chargeback came after you have already issued a refund, provide documentation to show the refund, amount and date. In case the cardholder no longer disputes the transaction and has solved the problem with you directly, provide proof as well.

Try to minimize your chargeback rates and prevent any possible disputes. Read another article to learn how to prevent chargebacks. Feel free to ask questions in the comments section below.

Open a merchant account for free

and start processing payments with Cardinity!

Anfieldfc

Hi good day I did a chargback using 13.7 code and the merchant acquiring bank refused to pay the money due to incorrect code used fatal error. The company Thomas cook shut down and therefore the hotel informed the client to contact the bank for a refund was I wrong to use 13.7?

Viktorija

Thank you for your question! The Thomas Cook case is very specific. As the company shut down, they had to issue refunds to clients. Your situation is not quite clear. If you could give some more explanations, it would be easier to understand. In any case, if the chargeback is not approved, you should contact your issuing bank to learn why.