“Do Not Honour” Payment Error Code: Reasons and Solutions

You have checked your transactions list and noticed that a big number of declined transactions are marked as Do Not Honour. What does it mean? It means that the cardholder’s issuing bank declined the payment for an unspecified reason. Such an explanation may still be vague and raise further questions. In this blog post, we will try to make things clearer.

First of all, it should be noted that all transaction decline statuses are sent by issuing banks. So, Cardinity does not determine the decline reasons in any way but only displays them in your account.

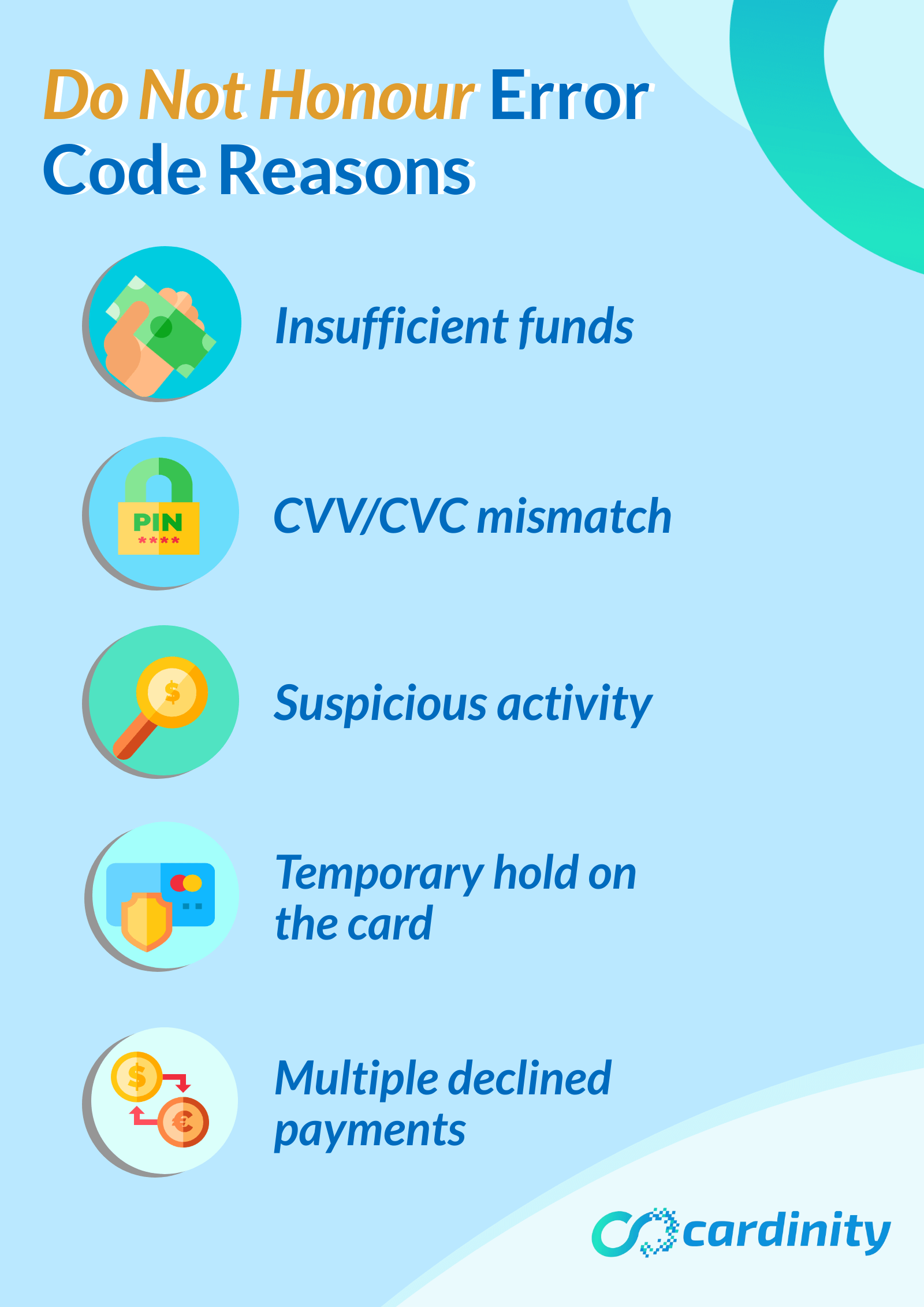

There can be various reasons why an issuing bank assigns Do Not Honour to certain transactions. Even though the bank does not provide explanations as to why a certain payment was declined with Do Not Honour, it is sometimes possible to find out the reason by looking at transaction details. Here are some of the logical explanations for Do Not Honour.

1. Insufficient funds

Even though there is a separate error code for insufficient funds, various issuing banks may mark a declined transaction as Do Not Honour instead of Not Sufficient Funds. If it is difficult for issuing banks to determine the correct response code, they use Do Not Honour as an all-inclusive reason. As Not Sufficient Funds is one of the most common reasons, it may be hiding under Do Not Honour.

2. CVV/CVC mismatch

Do Not Honour may also mean that a transaction was declined because of credential mismatch, e.g. CVV/CVC mismatch. The problem is that not all card networks and issuing banks have a special decline code for such mismatches. That is why the Do Not Honour response is used.

3. Suspicious activity

Card issuing banks have their own sets of factors which point to a cardholder’s suspicious or unusual behaviour. It does not necessarily indicate fraud; however, banks should prevent such transactions and protect cardholders’ funds. Some of the factors include the following ones: unusually large payment amount, transaction made at night, no additional authentication, multiple orders, or a previously made payment on a high-risk website. Usually, a transaction is declined when there is a combination of several factors. Unfortunately, as a seller, you do not receive any explanation from the bank but only the Do Not Honour response code.

4. Temporary hold on the card

For the same reasons as mentioned above, the card issuing bank may not only decline a payment but also put a hold on a customer’s card. If a customer tries to pay with a card which was put on hold, the issuing bank will respond with Do Not Honour.

5. Multiple declined payments

A customer may retry a payment if it has been declined once. After multiple declined payments in a row, the subsequent payment will be declined automatically with the response Do Not Honour. It means that the card has been temporarily locked, and the customer will not be able to make a payment without contacting the bank.

What to do in case of a Do Not Honour decline?

- First of all, you can ask your customer to use a different credit or debit card. If they don’t have another one, suggest alternative payment methods.

- You can also ask your customer to wait a few minutes or even hours and try again later. This solution does not always work for Do Not Honour declines because it may require assistance from the issuing bank.

- The customer can contact their bank and ask the bank to allow processing the payment on the merchant’s website.

- Moreover, ask the customer to check the card credentials to make sure that they entered everything correctly.

In order to avoid major issues with your customers, send notifications to inform them about declined payments and try to find a solution together. You can also add a coupon to the email as an apology for the occurred problems, so they would buy from you and not from your competitor. If you experience any problems or have any questions about payment error codes, feel free to contact us at Cardinity. You can also check the meanings of all response codes.

Open a merchant account for free

and start processing payments with Cardinity!